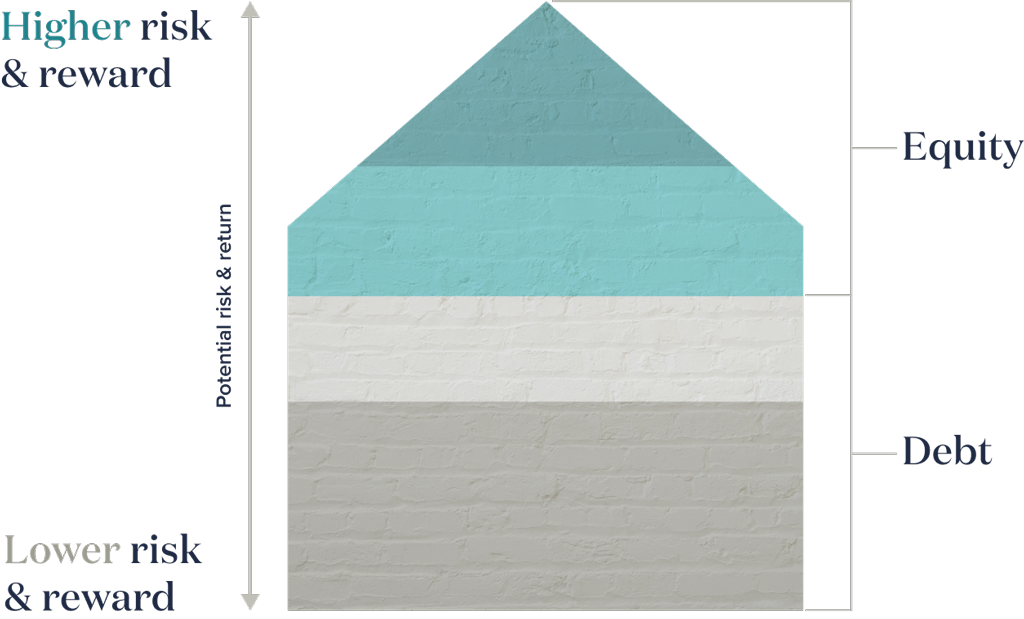

We use our institutional experience to bring investors differentiated opportunities that result from illiquidity and macroeconomic stress across two major strategies.

Equity-like returns via secured credit instruments

Event-driven strategies with asymmetric upside

We invest nationwide but maintain a particular focus on supply constrained submarkets

Your goals are unique and so are our solutions. We work closely with each partner to understand their objectives, offering tailored capital solutions that align with your vision for success and investment time horizon.

We understand the importance of mitigating risks in the world of real estate investment. Our robust risk management and underwriting strategies ensure that your investments are positioned to weather market fluctuations and deliver consistent, reliable returns.

Our vertically integrated approach means that we control every aspect of the investment process. From property acquisition and asset management to disposition, we maintain a hands-on approach to optimize performance at every stage of the investment cycle.

Backed by extensive market research and a team of seasoned professionals, we stay ahead of industry trends and opportunities, providing you with a competitive edge in the dynamic commercial real estate landscape.

—

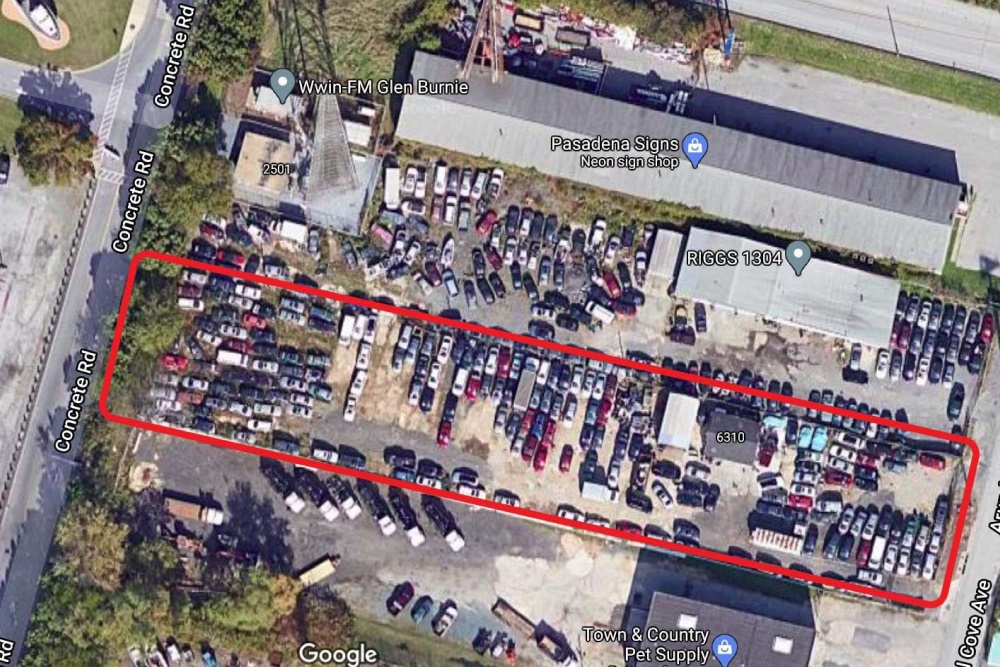

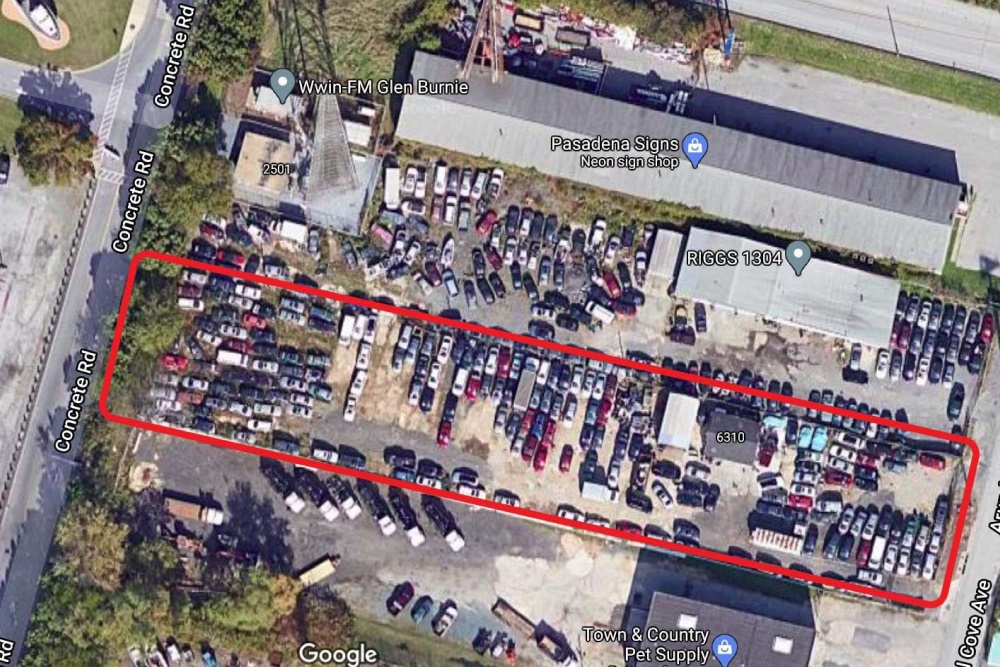

Entitlement in process.

—

Renovations complete.

—

Renovations complete.

—

Renovations complete.

—

Purchased from investor. Investment realized with par payoff.

—

Purchased from special servicer/hedge fund. Fee simple renovations in process.

—

Purchased loan from special servicer. Fee simple renovations complete.

—

Purchased from investor/fund. Loan workouts and modifications complete. Loans held to maturity.

—

Purchased pool of loans with varied performance from a bank. Loan workouts and modifications complete. Loans held to maturity.